Required Four Major Social Insurance Schemes

- Sep 23, 2022

- 1 min read

The hiring an employee requires a company to follow the labor laws in Korea. One of the requirement that most foreign invested companys does not expect to have is the four major social insurance schemes. Check out the following info about four major social insurance from 'investkorea.org'.

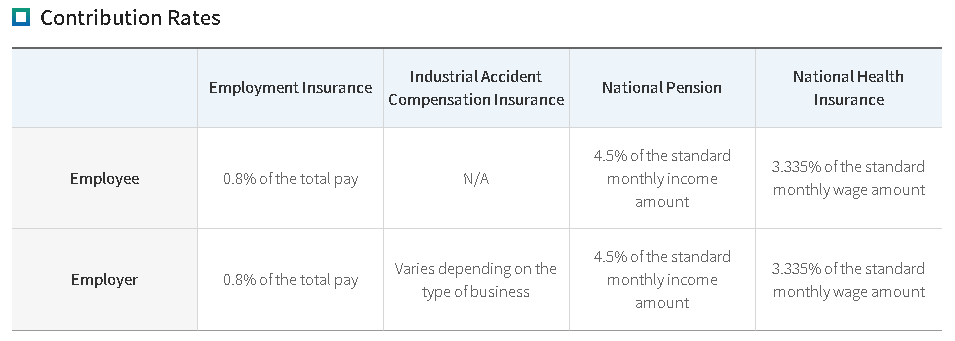

The four major insurances are employment insurance, industrial accident compensation insurance, national pension, and national health insurance.

※ The long-term health care insurance premium is 10.25 percent of the health insurance premium, which is collected with national health insurance. In the case of the vocational training program for employment stabilization, an employer pays 0.25 to 0.85 percent of the total pay, depending on the number of employees.

Comments